Investing in commercial real estate? Keep these factors in mind

Investors can earn much higher returns that are inflation-adjusted in commercial real estate compared to fixed deposits and other debt mutual funds.

Investors can earn much higher Investing in commercial real estate can appear daunting for an ordinary retail investor. Compared to residential real estate, an investor looking to invest in commercial properties must familiarize himself with various terms, lease structures, title diligence procedures, and basic cash flow models.

Once these concepts are mastered, commercial real estate investing will become a lot easier for the lay investor. Investors can earn much higher returns that are inflation-adjusted in commercial real estate compared to fixed deposits and other debt mutual funds.

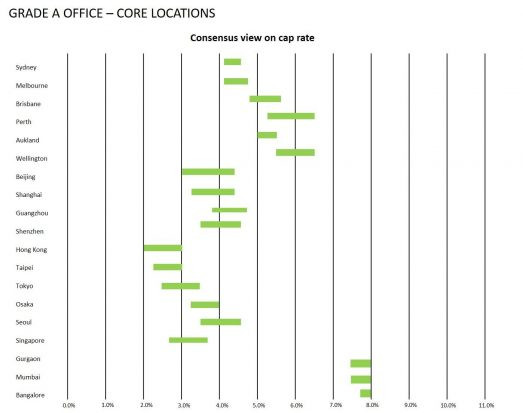

Capitalization rate or cap rate is a term that you will hear often when investing in commercial properties. The Cap rate is nothing but the rental yield on the property. It is calculated as Total Rent / Total Purchase Price. Commercial investors compare this to the risk-free rate in the market. In India, cap rates are currently at 8-12 per cent depending on the quality of the property and the tenant. The table below from a recent CBRE report shows the cap rate across asset classes and countries.

Interior Fitouts / Tenant Improvements (TIs) / Bare Shell / Warm Shell

In India, we use the term fit-outs to mean the interiors of the office. The West uses the term Tenant Improvements (TIs). An investor must ensure if the interior fitouts were done by the seller or the tenants. Usually in India Bare Shell offices (garage type) are delivered. The tenant needs to do the flooring, ceiling, lighting, air conditioning, wiring and interior cabins, conference rooms, etc. In the West, offices are mostly delivered Warm Shell in semi-finished conditions but without the furniture.

Some tenants like to do their own fit-outs while others ask the developer to do it for them for which they pay an additional fitout rent. Fitouts generally cost between Rs. 800-1,000 per SF (square foot) and developers charge Rs. 25-30 per SF per month (Rs. 300-360 per SF per year). A tenant who has done his own fit-outs is likely to stay longer in order to sufficiently recover the costs making them stickier.

Investors can earn much higher Quality: Grade B, B+ or A

Investors use Grades to describe the quality of a property. A building that has the advantage of having a superior grade and quality (Certification like LEED gold and platinum ratings/ buildings with nicer lobbies, more lift banks, higher ceiling, and better views) will attract quality clients faster. It will also ensure its investors better rents, client retention, and capital appreciation and even multinational tenants who can pay a premium. A quick resale of such properties is also ensured.

Market Rent Yield Vs. In-place rent Yield

This is a slightly advanced concept that sophisticated investors use to analyze how likely the tenant is to vacate or negotiate rents when they come up for renewal. Market rent is the rent currently trending in the market while in-place rent is the rent that the tenant is currently paying. These differ as market rents may escalate faster than in-place rents which typically escalate as per contract. For example, a tenancy contract may allow an escalation of 15% every 3 years whereas rents in the market may increase by 10% every year (depending on demand/supply) creating an imbalance. A prudent investor will look for lower in-place rents as this will mean that the tenant is unlikely to vacate as it will need to pay higher rents in the market if it does.

Lease Structure (3+3+3 or 5+5+5)

Commercial tenants are required to either lease for 3+3+3 years or 5+5+5 years with a rent escalation every 3/ 5 years. The lease mandates the owner cannot ask for a tenant to exit while the tenant is free to exit at any time that they desire to post the lock-in period of generally 3 years. Potential investors must understand and analyze these risks before making the investment. A longer lock-in clause is recommended top Real Estate Consultants.